Apologies for not having written a random thoughts post in 2 months, it’s been quite an eventful time with Cognition and Windsurf, combined with a ton of travel over the next few months hopefully I can squeeze more of these out. For those new to this blog, I typically dive deep into one technology (to the extent that it won’t get too boring for readers) and use this as “notes” so that I can refer back to them.

There’s been a ton of topics we could have covered, the obvious ones are the latest open source models, the next generation of frontier models, or even just generalized Reinforcement Learning education, but there’s one topic that’s been burning in my mind for the last few months and that is…are we in a bubble?

It’s time to pop the bottle of champagne, your friends startup has just raised their next round! Wait what’s this, so have all your other friends? Wait what’s this, there are hundred billion dollar valuations now- wait, did you say hundred billion dollar RAISES now?

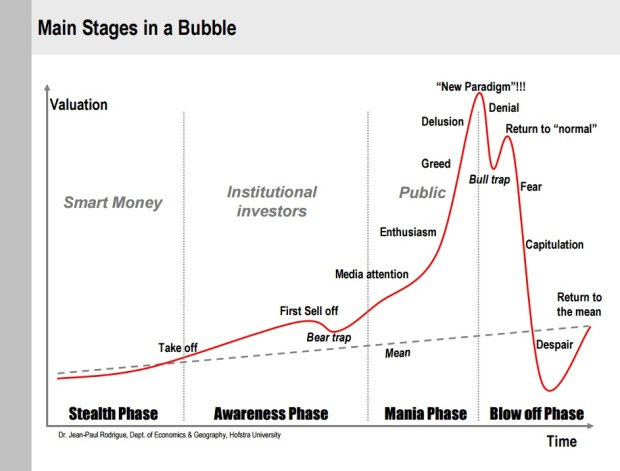

Typically there are lots of ways to cover bubbles, so maybe let’s just start with previous ones? I can already hear some of your thoughts, some of you are saying, “But this time it’s different, it’s a new paradigm shift…”

But that’s literally what this bubble chart says at the peak, which I’ve seen many times in my lifetime now (dotcom, mortgage crisis, crypto (eth/ICOs), crypto part 2 (defi/nfts), crypto part 3 (Perp wars/DATs)…this could go a while). Every single one of those bubbles, people believed we were in a new paradigm shift.

The main reason these were bubbles? You can argue lots of things, there can be the fact that revenue didn’t match valuations, too much cash was around and pushing valuations up, people going into leverage and raising their risk appetite…but that’s all pretty easy to verify, so why don’t we just take a look at a few data points just to get those out of the way.

S&P500 PE Ratios are elevated, as of writing they are nearing 30 (the typical average is usually 16), which typically lead to historic market corrections like the dotcom crash in 2000 (they were 40+), Mortgage crisis in 2008 (100+ but due to earnings falling rapidly), COVID bubble in 2020 (38), and there really isn’t a time ever where it’s gone above 25 without some major crash…but counterpoint, this time it’s more “forward looking” with AI on most of the highest market cap weight companies? Keep these numbers in mind, but we’ll move on

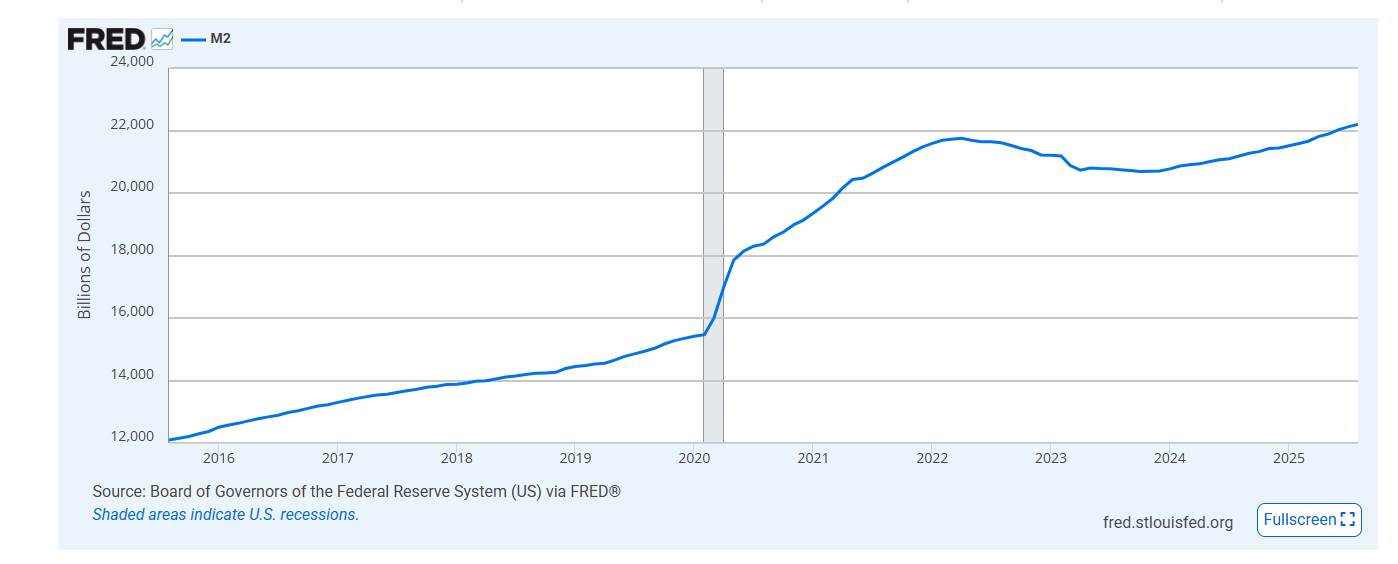

What about overall supply of money? M2 is now above 22T out there, it turns out raising interest rates only temporarily slowed the supply of money out there. Though I have to say, this metric is a bit hard to trust since M2 almost is always going up so you cannot correlate big corrections from it. I’d say, this metric doesn’t matter, so let’s stop using it as an excuse for a bubble (maybe for inflation though)

Wild fund raises is another signal, take a look at September alone, my LinkedIn feed had fundraise news everyday, and this is missing a lot of other raises. In past bubbles, fundraises were everywhere, driven by lots of capital needing to be allocated from people diversifying away from assets that had gone up in value. Remember when crypto was announcing a new fundraise everyday as well before the bubble popped? It again sounds similar here, but it doesn’t necessarily mean a pop is coming

Another bubble signal from the past was social media hype and to “keep buying”. Admittedly, this is more on the crypto side, but we are seeing social media hype cycles to buy one coin at a time, then seeing those coins jump up 2-3x in a few days before correcting back to baseline. You can see the charts of PUMP, HYPE, ASTER, and some of the digital asset treasury (DAT) stocks as examples. This is clearly bubble behavior as people try to maximize risk and returns. Strangely though, people are not saying this about the stock market, people are actually arguing whether we are in a bubble right now, that’s usually a positive sign as it makes people think before allocating money. It’s when everyone says “things will go way higher!” that we typically see things pop. So maybe it’s really crypto that’s in a bubble and not AI…

So at the surface level, for the question if past data matches current data before a bubble, the answer is yes. We have valuations that enter high speculation territory, wild fund raises, and social media hype. So what’s the argument that we are not in a bubble? Let’s cover both the bull and the bear cases of the AI scene and see if we can parse out what signals to actually look for

The Bull Case (why it’s not over yet)

First of all, the Fed still has a lot more it can cut on interest rates. So barring any other events, as long as interest rates keep going down, it’s possible that the stock market keeps going up. For those trying to short the market with all the bubble talk, remember the market can remain irrational longer than you can remain solvent. In fact, if there is any correction at all, the Fed could just cut rates again and markets would do a V shaped recovery. This could last years, but there’s always something that catches the market off-guard

What about revenue ceilings? Let’s look at a comparison to hyperscalers like AWS, GCP, and Azure. The reason why is that these foundational model companies spending all this money are starting to act like these cloud service providers. They are becoming the infrastructure to power so many of these new products and apps. These 3 hyperscalers went from double digit billions to now above hundreds of billions in revenue (roughly $200B but combined with others we are talking trillions of dollars in revenue), this is likely what powers all the AI solutions today also. On one side you could argue that the equivalent amount of revenue could go into AI, but on the other side you could argue most of this revenue is already AI.

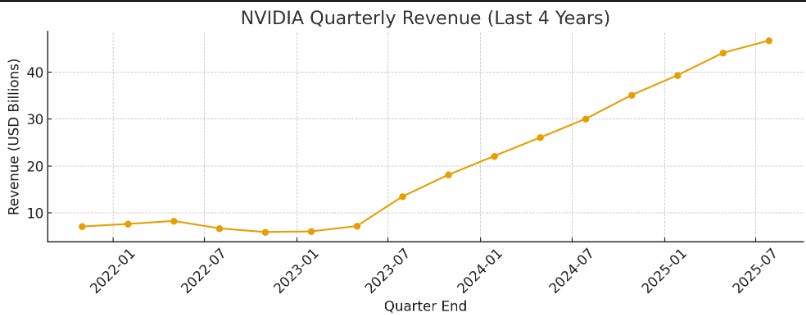

What about GPU demand? Nvidia quarterly revenue is also key here, it shows the barometer for AI demand. The problem is that we don’t know the actual demand, only that there’s not enough right now and companies need to buy them ahead of time so that they can build out the datacenters to support the workloads. You’ll notice though that last quarter had a slight change on the linearity of the graph:

That’s not to say it’s a red flag, but one thing that I’ll mention later is monitoring earnings growth from Nvidia is perhaps the biggest signal of how to think about if we are in a bubble or not. Even with competition starting to heat up.

Okay, let’s continue the bull argument before diving into bear. Right now, all the model providers are still demand constrained, they are still growing exponentially to the tune of doubling token counts every 2 months. This is largely due to model advancements compounded with a surge in users. On the model advancements side, AI is consuming more tokens. We went from doing single shot prompts and answers, to inference time reasoning (thinking) which generates way more expensive output tokens, to agents, which do this over and over until a solution is met, and now we have million token context windows which take up more GPU memory as well.

New business models will also emerge. ChatGPT released the ability to do instant checkout via Etsy, Shopify, and payments with Stripe. It’s setting up itself to be a funnel for all shopping needs, and that opens the door to ads and other sources of revenue. In fact, of all the bubble talk, when it comes to OpenAI’s core business, I think there’s way more runway to be made in terms of revenue. The question is whether the $500B valuation becomes a $2T at a rate that makes sense with their revenue growth. It seems that the market thinks it’s inevitable and trying to get the capital to do so. The problem is, we cannot say the same for all AI companies, which is a good segue into the next section:

The Bear Case (is it over…!?)

Right now, ironically, GPUs are getting way more efficient, to the tune of being faster than Moore’s law. Every next generation of Nvidia chips seems to solve so many problems, but with the advancement of AI it becomes obsolete very quickly. If there is any moment where AI advancement does not require fully utilizing the latest generation of GPUs, that’s where there is a red flag. This has not happened at all yet. Every 10x in GPU compute always unlocks the next tier of intelligence for these models, but that’s where it could be a bear argument. Will we hit a tier where we go from $100B of spend to $1T in spend? Here lies the problem, it will be extremely difficult to raise $1T, maybe OpenAI is proving it is not impossible, but when we go from $1T to $10T, well, come on now. So the biggest indicator of a bubble is when we run out of funds to achieve the next tier of intelligence. Remember though, there are also scientific breakthroughs and algorithmic efficiencies that can reduce that number.

Another argument that’s been brought up is the limitation of power, this could represent the ceiling of actual growth. However upon further research, it seems like AI is around 3-5% of the US power consumption. Yes, that’s a big number, but we are adding roughly 63 GW this year in the US alone and it appears that there are a lot of methods to keep adding electricity that don’t involve building a nuclear reactor. Basically, at the current rate of growth we are in line with our demand. I guess if we go from that $1T to $10T idea, this is where we may hit the same ceiling as above.

The biggest red flag however, is that not all the AI companies can bring in enough revenue to justify their valuations. That’s where I am in agreement. There are just way too many companies now, all at very high valuations, to justify the revenue multipliers. That is NOT saying that the very best and smartest companies will survive, it simply means that the pie hasn’t grown big enough for everyone. There will be a period of time where revenue growth to spend on all these solutions won’t match the trajectory the fund raising is moving at right now. I can see companies like OpenAI pull in ad revenue on top of the subscription model, but I can also see the existing mega companies like Meta and Google starting to take market share from the other startups as well. All in all, the AI startup ecosystem is roughly $2.7T right now, with $1T alone from the list in my last news article. I have to say, $2.7T is very reasonable for the total valuation, the problem is if growth keeps pace with this or if it gets sucked up by the Mag7.

Okay, what’s your actual thoughts Jeff

All in all, I think we’re not going to pop the bubble just yet. There’s still too much demand for GPUs and inference, and there’s too many advancements still happening in the technology to think we’re close to flattening out. That being said all the points above still hold true, and don’t worry here’s a list of things I’ll be watching for flags if we are actually getting close:

Less GPU demand if…Models don’t improve fast anymore - this is a signal that people will invest less in pre-training datacenters which will drive down the demand for GPUs. That being said, there are use cases (like Sora 2) which could potentially drive up the inference demand, but the revenue from Sora 2 would have to justify this

Markets panic if…Nvidia revenue slows - This is the biggest flag that will spook markets. If Nvidia goes down, everything else goes down, even if a viable alternative emerges.

Growth ceiling…Power consumption spike - If for some reason we actually reach a ceiling of models consuming too much power, that will mark the ceiling of how fast AI can grow (barring efficiency and algorithmic improvements). This would readjust the valuations curve based on growth timelines. I don’t see this happening though.

Fast unwind…Leverage/Debt doesn’t get met - We are now seeing data center buildouts financed by debt, we are seeing companies borrow (Anthropic raised debt earlier this year, OpenAI is using debt and credit lines to fund much of its ventures (Softbank used debt to buy OpenAI equity), Coreweave used billions in financing to build out its infrastructure, as did a lot of the cloud service providers.). Basically, if there is a bubble pop from AI, I think the first domino will be one of the companies default on their debt, and things unwind quickly. Again, we’re not quite there yet, but we’re adding on risk as more and more debt gets raised to fund these build outs. OpenAI makes $13B in revenue and will likely hit $20B by end of year, how will it pay its $300B Oracle bill? If the answer is “continue raising”, then what happens after the next order of magnitude jump?

As you can see, there are a lot of signs for a bubble, but we’re not quite at the cusp of a pop. In terms of revenue growth, inference demand, and most importantly, advancement in the technology. As long as we keep advancing, there will be more demand and use cases that get unlocked, which then unlocks more revenue to justify these valuations. After releases like Sonnet 4.5 from Anthropic and Sora 2 from OpenAI, we see there are still major leaps being made. In fact, I had trouble finishing this article because I was playing with Sora 2 so much, that I am positive there will never be enough GPUs for it. That then begs the question, when will AI companies weigh the trade offs of building profitable businesses before defaulting on their loans? Perhaps that is the thing we should keep our eye on.

Thanks Jeff w